Integrating personal investment portfolio into a secure and confidential wealth management solution

Overview

A major challenge for life insurers in fast growing markets is to manufacture and distribute products in an efficient manner and thereby outperform their peer-group. However, this is often limited by the strain, conservative supervisory reserves or high initial distribution costs. Our Advisors will provide an insurer-to-insurer comparison to highlight the various strengths and shortcomings of a solution. Our tailor-made solutions backed by our own inhouse qualified actuaries, is sought after in high growth wealth management markets like South East Asia and East Asia. Effectively, this enables our clients to enhance their wealth management portfolios and legacy planning objectives.

Complementary partnership

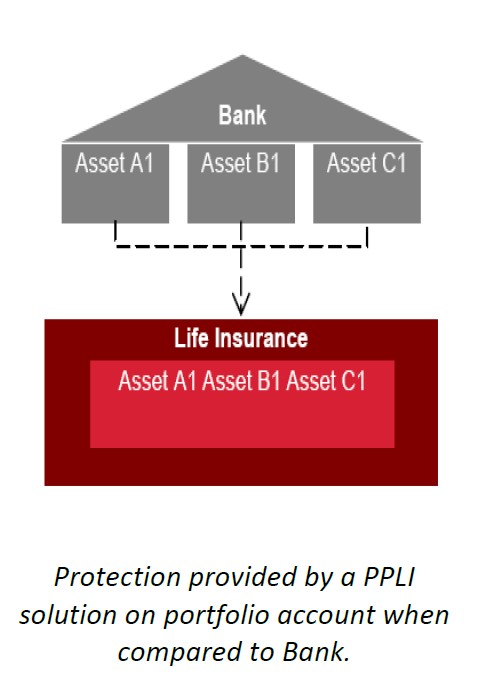

Whereas, in traditional life insurance, banks, asset managers and insurance companies vie for the assets of individual customers, this form of business sees them working as partner. The responsibility for managing the assets (typically paid as Single Premium for such policies) placed with the insurance company , rests with the customers and their banks and asset managers, with little changes in the relationship between customer and financial institutions. Customers are free to change the structure of their “deposit” during the policy term. PPLI Asia already cooperates with a large number of banks, insurance companies and asset managers worldwide.

Involvement of an Insurance Company in Wealth Preservation and Asset Protection

While buying life insurance is not an exciting topic for most people, a private placement life Insurance policy is an essential component of this planning and, when properly established, extensive advantages can be obtained.

Flexible & Effective Estate Planning

The income tax benefits of life insurance include: (1) tax-free earnings (dividends, interest, and capital gain) on policy assets; (2) the ability to withdraw and to borrow assets from the policy cash value free of income tax (with proper structuring); and (3) the receipt of policy proceeds by the policy beneficiaries at the death of the insured by contract i.e. as directed by the Policyholder.

One step ahead

We can advise on which Life Company, how to structure a portfolio and which Legal Jurisdiction may provide the most suitable PPLI solution for each international HNWI.

PPLI Asia specializes in bespoke structured life insurance solutions and the legacy planning needs for high net worth individuals. Working closely with our various partners and stakeholders, we are confident that we can help our HNWI clients to achieve their wealth management goals.